The Streaming Iceberg: Why 88% of Movies Aren’t on Netflix, Disney+, or HBO Max

If you’re an executive at a major streaming service, here’s a stat that should make you rethink your content strategy:

Only about 12% of movies in active distribution are available on the top eight U.S. subscription streaming services – roughly 34,000 out of more than 280,000 titles.

For TV shows, the picture is only marginally better.

Only 21% of the approx 68,000 series tracked globally make it onto Netflix, Disney+, HBO Max, Hulu, Amazon Prime Video, Paramount+, Peacock, or Apple TV+.

The remaining 88% of movies and 79% of TV shows?

They’re either scattered across hundreds of smaller SVOD services, on AVOD, locked behind TVOD paywalls, unavailable in the United States entirely—or some combination of all three.

This isn’t a story about content scarcity. It’s a story about fragmentation, geographic licensing complexity, and a massive opportunity hiding in plain sight.

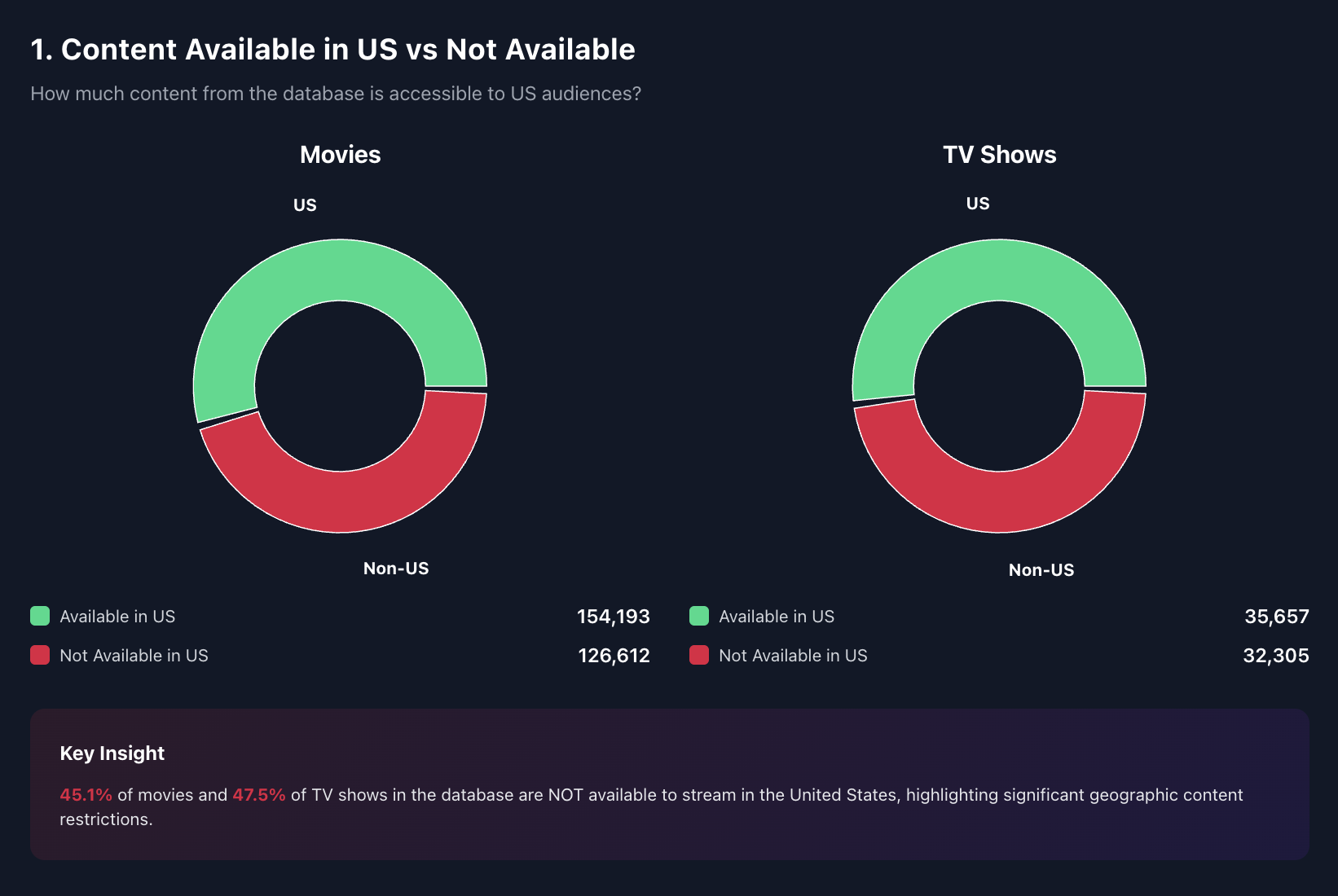

The Geographic Gap: Nearly Half of All Content Is Invisible to U.S. Audiences

Before we dive into U.S. streaming fragmentation, let’s zoom out.

The first surprise in Reelgood’s data isn’t about which platform has what. It’s about how much content simply isn’t available to American viewers at all.

These aren’t obscure art films or foreign-language indies flying under the radar. They’re titles with active distribution deals in other markets, often licensed to services in Europe, Latin America, or Asia-Pacific.

This creates two major strategic blindspots:

- For U.S. platforms: Tens of thousands of titles with proven international demand are sitting unlicensed domestically—often because rights holders prioritize markets with less competition or higher per-subscriber revenue.

- For global streamers: The inverse is also true. Titles that perform well in the U.S. may have zero distribution in key growth markets, leaving money on the table for studios and streamers alike.

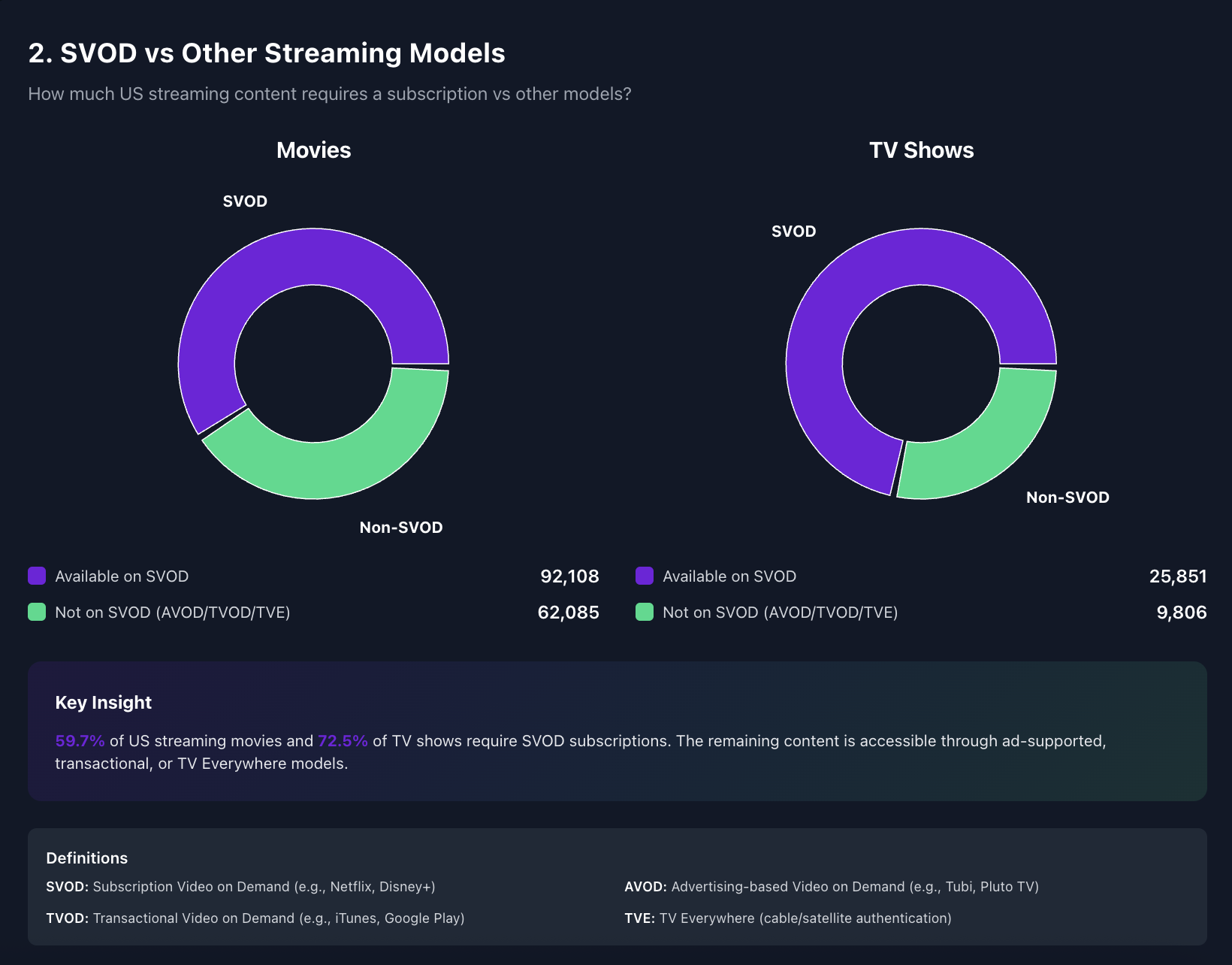

The Subscription Myth: SVOD Doesn’t Mean Universal Access

Now let’s focus on the 154,000+ movies that are available somewhere in the United States.

When industry conversations focus on “the streaming wars,” the assumption is that most content lives on subscription platforms. The data tells a more nuanced story.

This bifurcation matters for product strategy. A user who subscribes to three major streaming services may still need to rent a movie on Apple TV, watch ads on Tubi, or authenticate with their cable login to access a lot of available content. The “subscribe and stream everything” promise of the early streaming era has given way to a hybrid reality where business model matters as much as platform presence.

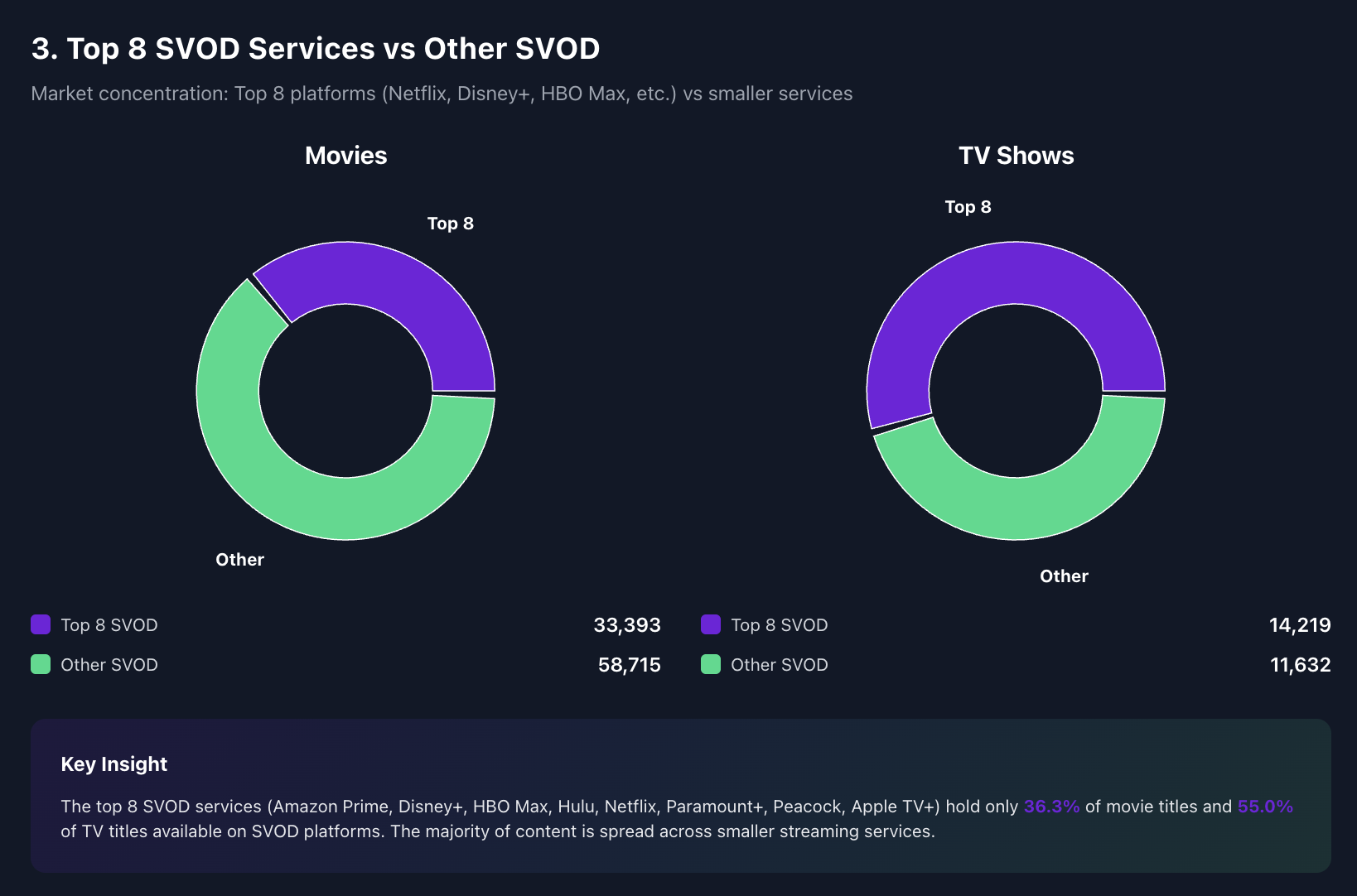

The Long Tail Is Longer Than You Think

Here’s where the concentration story gets really interesting. Of the 92,000+ movies available on SVOD services in the U.S., how many are actually on the platforms most consumers subscribe to?

The other 59,000+ films and almost 12,000 series?

They’re distributed across a fragmented ecosystem of niche streamers: genre-specific services, international platforms with U.S. footholds, legacy cable apps, and specialty aggregators.

Consider the math: of the 280,000+ movies in Reelgood’s global database, only 34,000—less than 12%—are available on Netflix, Disney+, HBO Max, Hulu, Amazon Prime Video, Paramount+, Peacock, or Apple TV+ combined.

The remaining 88% live somewhere else entirely, or nowhere accessible to U.S. consumers.

For TV shows, the concentration is slightly higher. 21% of all series make it onto the top eight.

But even that means four out of five shows require looking beyond the household-name streaming services.

Why Execs Should Care

This isn’t just a fun data exercise.

The fragmentation and geographic gaps in streaming availability have direct implications for how platforms build products, negotiate deals, and compete for viewers:

- Product & Discovery: Viewers searching for a title inside a top-8 app may not find a popular catalog item available elsewhere—a discovery opportunity for aggregation, metadata services, and universal search tools that surface where content actually lives.

- Licensing & Partnerships: A large pool of streamable titles outside the top-8 represents an addressable library for distribution deals, white-label bundling, or second-window acquisitions. If your platform isn’t in the top eight, this is your competitive advantage.

- Market Intelligence: Global availability gaps—titles only distributed outside the U.S., or locked to AVOD in one region and SVOD in another—point to geo-license arbitrage opportunities and inform where studios should prioritize catalog sales or platforms should expand.

The Aggregation Advantage

For years, the industry assumed that consolidation would solve the discovery problem. If Disney bought Fox and Warner bought Discovery, surely viewers would find everything in one place, right?

The data says otherwise.

The top eight services have gotten bigger, but the long tail has gotten longer. FAST channels, AVOD libraries, and international niche streamers are proliferating faster than the major platforms can license content.

Meanwhile, studios are experimenting with hybrid distribution—licensing the same title to SVOD in one window, AVOD in another, and TVOD in a third.

For viewers, this means decision fatigue. For platforms, it means missed engagement. And for rights holders, it means undermonetized catalogs.

The companies that win in this environment won’t be the ones with the biggest libraries.

They’ll be the ones with the best maps—the movie & TV metadata, licensing intelligence, and real-time availability data to help viewers find content, help platforms acquire it strategically, and help studios maximize the value of every title in every market.

What’s Next?

Reelgood indexes 280,000+ movies and almost 68,000 TV shows across multiple markets.

We track not just what’s available, but where, how, and under which business model.

If your team wants to identify which high-value titles are sitting outside the top-8, unavailable in key markets, or ripe for re-licensing, we can surface title-level lists, studio/genre breakdowns, and market-by-market availability maps.

Because in a world where 88% of movies aren’t on the platforms most people subscribe to, the question isn’t “What should we license next?”

It’s “What are we missing—and where is it hiding?”

Ready to Map the Content You’re Missing?

If you’re a product lead looking to prioritize catalog gaps, request a title-level export of high-demand content missing from the top-8, tagged by genre and availability.

Content and distribution teams can access detailed breakdowns of the 59,000 non-top-8 SVOD movie titles (and almost 12,000 TV shows) to identify licensing opportunity areas.

And if you’re building a global strategy, we’ll surface the 127,000 movie titles and 32,000 TV shows unavailable in the U.S., ranked by existing market availability and Reelgood user engagement signals.

Contact our team to get started—or if you have a specific catalog question, reach out directly at sales@reelgood.com. Let’s find what you’re missing.

Data sources: Reelgood Movie & TV Metadata & Streaming Availability Database, November 2025. “Top 8” defined as Amazon Prime Video, Disney+, HBO Max, Hulu, Netflix, Paramount+, Peacock and Apple TV.