Distribution at Risk: The Hidden Stakes in the Warner Bros. Discovery Bidding War

When Warner Bros. Discovery agreed to merge with Netflix in late November, the deal appeared settled. But Paramount Skydance continues to pursue an aggressive counter-bid (CNBC), even as Netflix moves toward closing.

The question isn’t whether Paramount Skydance can outbid Netflix; it’s whether the company can afford not to.

The answer lies in distribution rights, not only library overlap.

Warner Bros. Discovery doesn’t just produce content for its own HBO Max streaming service. It distributes hundreds of popular movies and TV shows to competing platforms, including Netflix, Paramount+, and Peacock.

If Netflix acquires WBD, it would gain control over those distribution agreements – and the power to terminate them as contracts expire.

Using Reelgood’s comprehensive streaming availability database, we analyzed which services face the greatest exposure to potential WBD content loss.

The results reveal why Paramount Skydance has the most to lose, and the strongest motivation to keep bidding.

Key Findings: Asymmetric Distribution Risk

When examining WBD-distributed content across the three competing platforms, the vulnerability is strikingly uneven:

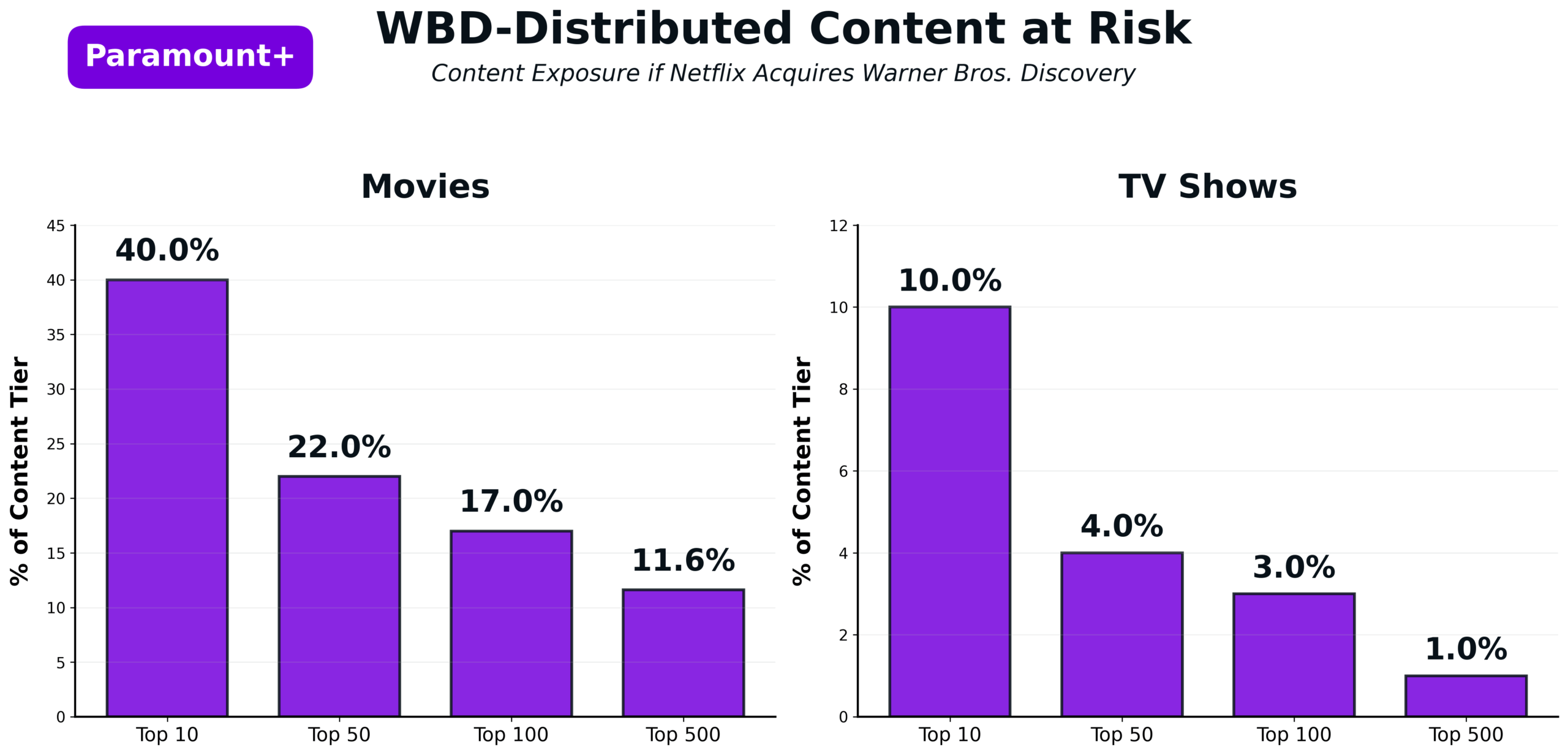

- Paramount+ faces severe concentration risk in premium content: 40% of its Top 10 movies and 22% of its Top 50 movies are distributed by Warner Bros. Discovery

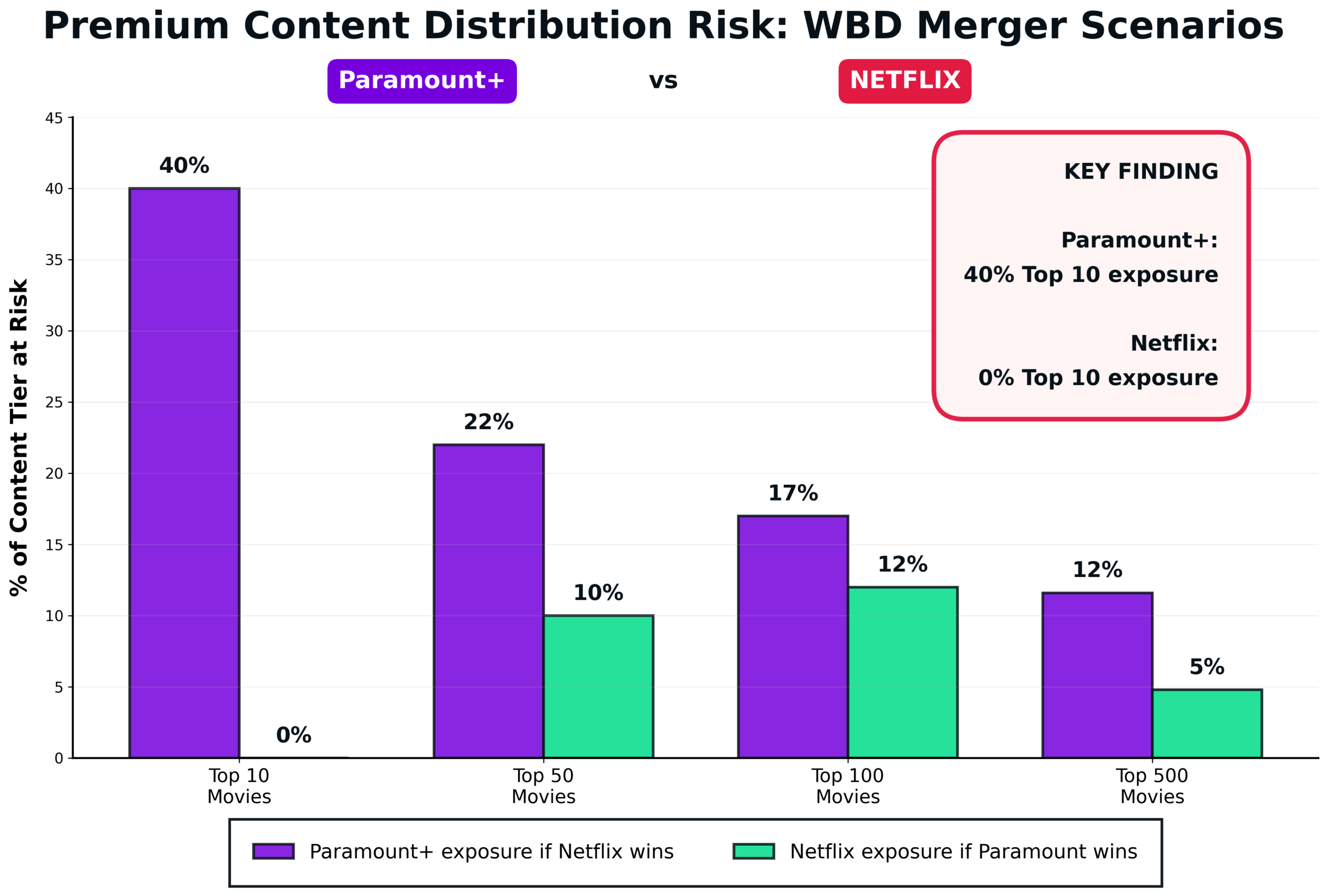

- Netflix has minimal exposure: 0% of its Top 10 movies and just 10% of its Top 50 movies come from WBD distribution

- The risk compounds at scale: Paramount+ could lose 11.6% of its entire Top 500 movie library if WBD content disappeared

- Paramount+’s vulnerability is most acute in its premium tier: While Paramount+ has 58 WBD-distributed movies in its Top 500, a full 19% of that exposure (11 movies) sits in just the Top 50, the premium tier that drives subscriber engagement and retention

This isn’t only about total library size. It’s about where the dependencies lie within each service’s most valuable content.

Paramount+ WBD Distribution Risk by Content Tier – If Netflix acquires Warner Bros. Discovery, Paramount+ could lose 40% of its Top 10 movies and significant portions of its most popular content. [Source: Reelgood metadata and title availability database]

The Paramount Skydance Problem: Premium Content Dependency

The data reveals Paramount+’s acute vulnerability.

While the service maintains a large overall catalog (thanks largely to Pluto TV’s 14,000+ movie library), its premium tier – the content that justifies subscription pricing – relies heavily on Warner Bros. Discovery distribution.

Consider the Top 10: Paramount+ currently carries 4 of its 10 most popular movies through WBD distribution deals. These aren’t catalog filler titles. They’re the blockbusters and fan favorites that drive new subscriptions and prevent churn.

The exposure cascades through the Top 50 (22% WBD-distributed), Top 100 (17%), and extends into the Top 500 (11.6%).

This creates a compounding problem: losing WBD content wouldn’t just remove individual titles—it would hollow out Paramount+’s competitive positioning across multiple content tiers simultaneously.

For Paramount Skydance, the company formed in August 2025 through the merger of Paramount Global and Skydance Media, with CEO David Ellison (Wikipedia) still integrating the combined operations, this represents an existential threat.

The company is already navigating a complex post-merger integration, managing declining linear TV revenues, and competing against streaming giants with deeper pockets.

Losing 40% of its most popular movie catalog would severely damage Paramount+’s ability to compete, particularly against a newly enlarged Netflix-WBD combination.

Side-by-Side Comparison – The asymmetric risk becomes clear when comparing what each service stands to lose. Paramount+ faces 40% Top 10 exposure while Netflix has 0%. [Source: Reelgood metadata and title availability database]

Why Netflix Can Afford to Wait

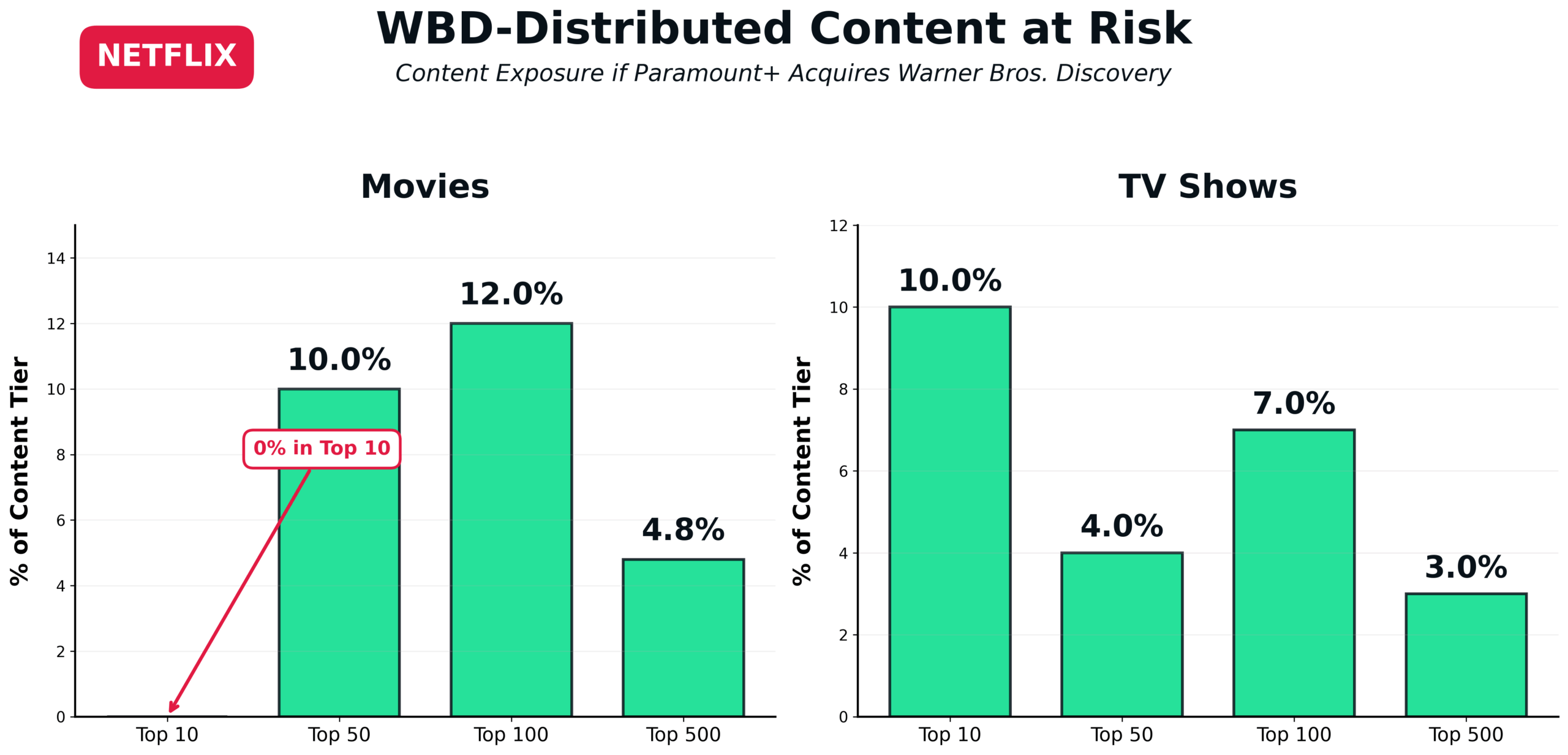

The reverse scenario, Paramount Skydance acquiring WBD, poses minimal threat to Netflix.

The streaming leader currently has zero WBD-distributed movies in its Top 10, and just 10% exposure in its Top 50.

Even if Paramount Skydance were to gain control of WBD and terminate distribution agreements, Netflix’s core library would remain largely intact.

This asymmetry explains the bidding dynamics.

Netflix can approach the WBD acquisition as an offensive opportunity—a chance to gain valuable IP, strengthen its content library, and potentially weaken a competitor. But Netflix doesn’t need WBD to maintain its current position.

Paramount Skydance, by contrast, faces a defensive imperative. If Netflix wins, Paramount Skydance must either:

- Replace 40% of its Top 10 movie catalog with equally popular content

- Renegotiate expensive distribution agreements with a competitor that has every incentive to let them expire

- Accept a significant degradation in its premium content offering

None of these options are attractive.

The first requires substantial content investment in an already capital-constrained environment.

The second puts Paramount Skydance at Netflix’s mercy.

The third undermines the entire Paramount+ value proposition.

Netflix WBD Distribution Risk by Content Tier – The reverse scenario poses minimal threat to Netflix, with 0% Top 10 exposure and just 10% Top 50 exposure. [Source: Reelgood metadata and title availability database]

The Distribution Calculus: More Than Only Content

This analysis illuminates why distribution control matters as much as content ownership in streaming mergers.

Warner Bros. Discovery’s value isn’t limited to the HBO Max library and Warner Bros. studio output. It includes distribution relationships that span the competitive landscape.

When Netflix and WBD announced their merger agreement (CNBC), media coverage focused on library overlap, content complementarity, and combined subscriber counts.

But the hidden impact lies in these distribution agreements: contracts that give WBD the power to supply or withhold popular content from competing platforms.

Some important caveats apply.

Existing distribution agreements typically have fixed contract terms, meaning any content withdrawal would occur gradually as deals expire rather than immediately post-merger. Additionally, aggressive content removal could trigger regulatory scrutiny, particularly if it substantially harms competitors in ways that concern antitrust authorities.

But these moderating factors don’t eliminate the risk; they merely delay it.

For Paramount Skydance, the calculus is clear: a Netflix-controlled Warner Bros. Discovery represents a structural threat to Paramount+’s competitive positioning, particularly in premium content where differentiation matters most.

In fact, as in one of its own movies in which it does have distribution rights, it might be said that it’s facing its own “Clear and Present Danger.”

Strategic Intelligence Requires Comprehensive Data

This analysis was possible because Reelgood maintains real-time tracking of content availability and distribution across all major streaming platforms.

Our database captures not only what content exists, but who distributes it, where it’s available, and how that availability changes over time.

For media companies, investors, and strategic advisors navigating M&A scenarios, this granular distribution data is essential. Content overlap tells part of the story.

But understanding distribution dependencies (who controls what, where vulnerabilities lie, and how leverage could shift post-merger) requires comprehensive metadata tracking across the entire streaming ecosystem.

As the Warner Bros. Discovery bidding war continues (CNBC), the companies involved are undoubtedly running similar analyses of their own.

The question isn’t only which combination creates the biggest library or the best content fit. It’s which outcomes create the most risk—and for whom.

About the Data: This analysis draws from Reelgood’s comprehensive streaming metadata database, tracking real-time content availability across Netflix, Paramount+, HBO Max, Peacock, and hundreds of other streaming services.

For information on leveraging Reelgood’s data for strategic intelligence, M&A analysis, or industry research, contact us at data@reelgood.com.