How TCM Could Transform Netflix’s Catalog: A Data-Driven Look at the Potential Acquisition

Netflix’s reported interest in acquiring Warner Bros. has sparked conversation across the industry, but one under-discussed piece of the deal deserves attention: Turner Classic Movies.

While the streaming giant has focused heavily on originals and recent releases, our analysis of streaming catalog data reveals that TCM could address a significant gap in Netflix’s library and meaningfully differentiate its offering in an increasingly crowded market.

Netflix’s Classics Problem

Netflix has built its reputation on fresh content, binge-worthy originals, and algorithmic recommendations tuned to modern viewing habits. But that strategy has come at the cost of catalog depth, particularly when it comes to older films.

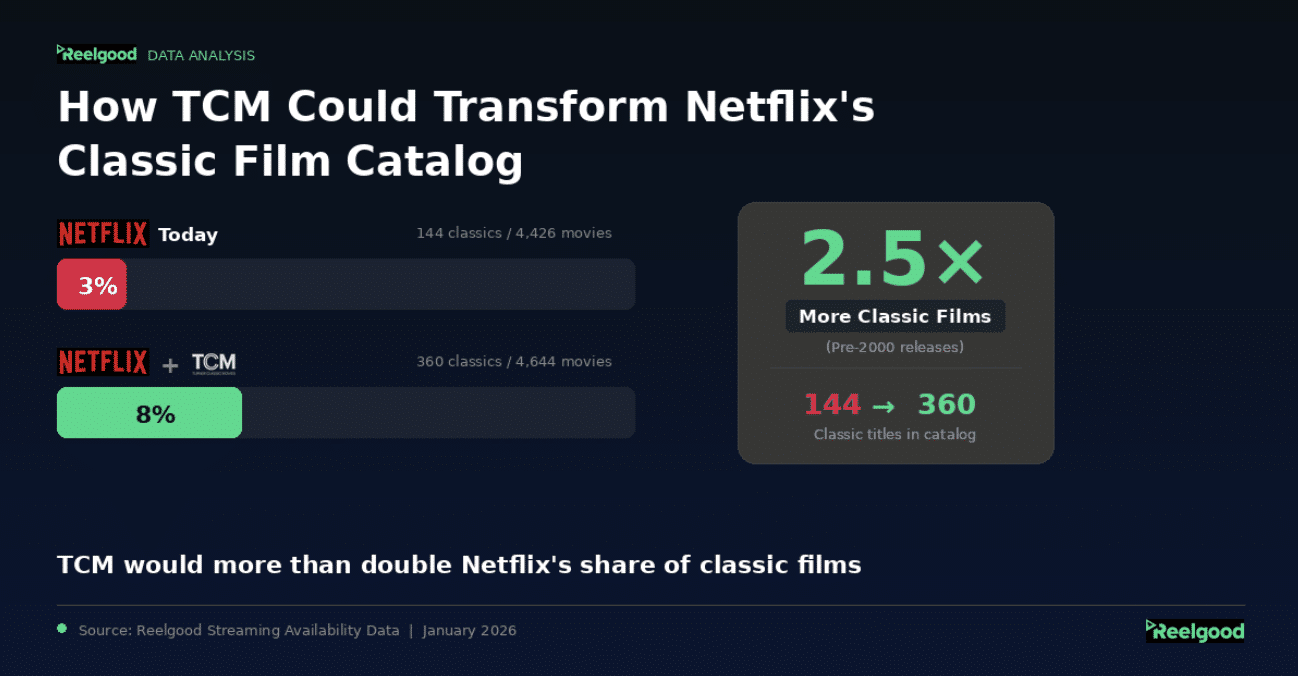

According to Reelgood’s streaming availability data, only 3% of Netflix’s current movie catalog consists of titles released before 2000. Out of 4,426 movies available on the platform, just 144 qualify as “classics” by this measure.

For a service that positions itself as a comprehensive entertainment destination, that’s a notable blind spot.

What TCM Would Add

The Turner Classic Movies catalog would bring a meaningful injection of pre-2000 titles to Netflix. Our analysis shows:

| Netflix Today | Netflix + TCM | |

| Total Movies | 4,426 | 4,644 |

| Movies Released Before 2000 |

144 | 360 |

| % Classics | 3% | 8% |

Adding TCM’s library would more than double Netflix’s share of classic films, bringing the pre-2000 percentage from 3% to approximately 8%.

The total catalog grows by 218 titles, with the vast majority of those additions (216 films) being classics.

In other words, TCM delivers exactly what its name promises: classic movies that Netflix currently lacks.

Why This Matters for Netflix’s Competitive Position

The streaming landscape has fragmented significantly. As services compete for subscriber attention, catalog differentiation becomes increasingly important.

Several factors make TCM a strategic asset:

- Exclusive positioning. No other major streaming platform has made classic cinema a core part of its identity. While competitors chase the same theatrical windows and prestige originals, Netflix could carve out a unique position by becoming the go-to destination for film history.

- Audience expansion. Classic film enthusiasts represent an underserved segment in streaming. TCM’s dedicated viewership has demonstrated a willingness to pay for curated, well-presented classic content.

- Cultural credibility. TCM brings more than just titles. The brand carries curatorial authority built over decades, along with relationships with filmmakers like Martin Scorsese, Steven Spielberg, and Paul Thomas Anderson, who have actively supported the channel’s preservation mission.

- Catalog longevity. Unlike recent releases that cycle through licensing windows, classic films represent a stable, long-term catalog asset with minimal ongoing acquisition costs.

The Bigger Picture

Netflix’s potential TCM acquisition reflects a broader industry question: as streaming services mature beyond the growth-at-all-costs phase, how do they build durable, differentiated libraries?

For Netflix, TCM represents an opportunity to address a clear catalog weakness while acquiring a brand with built-in audience loyalty and cultural cachet.

The numbers tell the story: a relatively modest addition of 218 titles would more than double Netflix’s classic film inventory and signal a strategic expansion into territory no major competitor currently owns.

Whether Netflix sees the value in classic cinema the way TCM’s devoted audience does remains to be seen. But from a pure catalog perspective, the math makes sense.

Methodology: Analysis based on Reelgood’s streaming availability database tracking 300+ services. “Classic” films defined as titles with release dates prior to January 1, 2000. Netflix catalog data current as of January 2026.

Reelgood tracks streaming content availability across 300+ services with 99+% accuracy. For enterprise data solutions, visit data.reelgood.com.