Most Streaming Catalogs Are Shallow. These Three Platforms Are the Exception

Key Takeaways

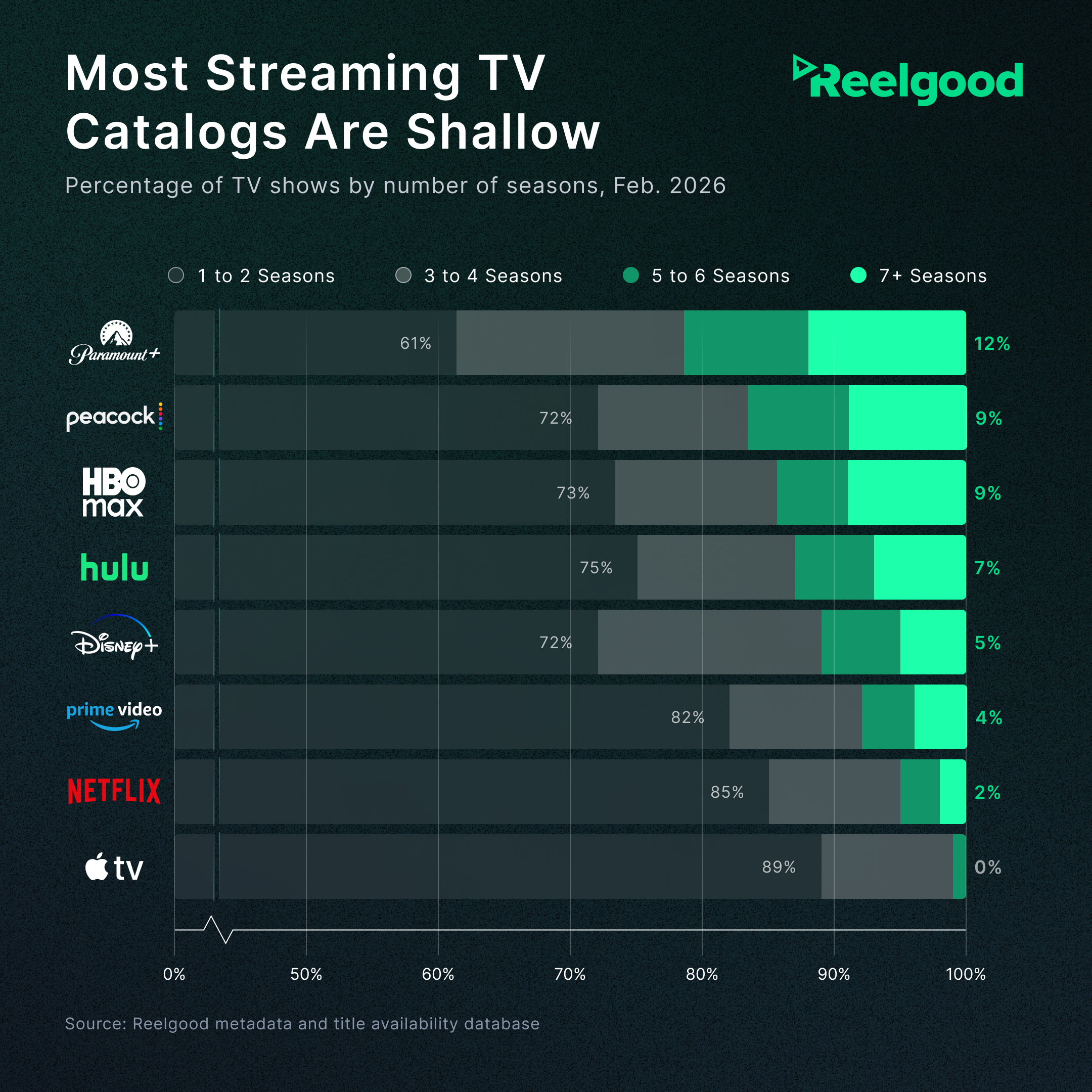

- Most streaming catalogs are shallow. Across almost all major platforms, 72% to 89% of TV shows ran for only one or two seasons. Prime Video, Netflix, and Apple TV skew heaviest toward short-run content.

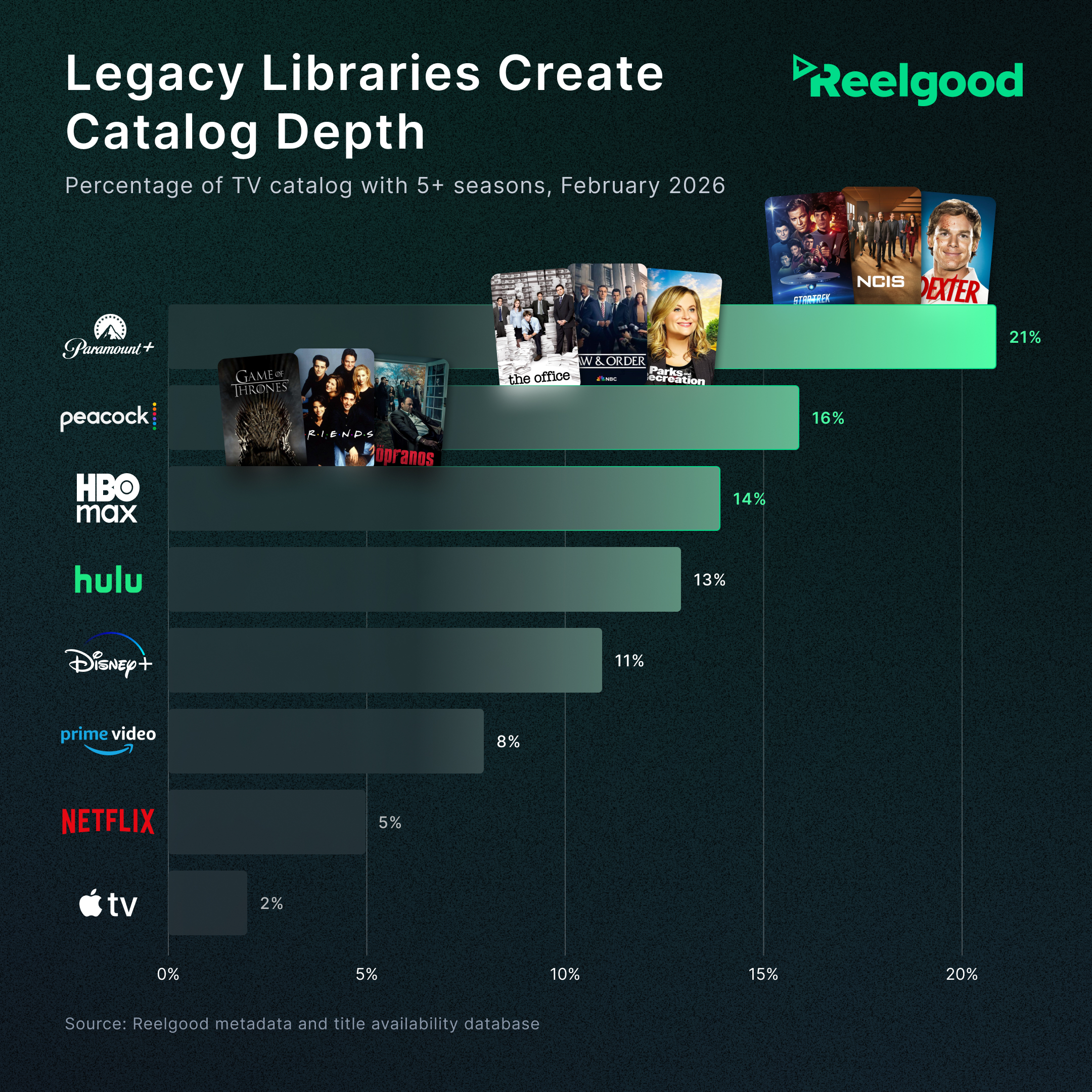

- Paramount+, Peacock, and HBO Max have the deepest benches. These three platforms lead in multi-season series, with 14% to 21% of their catalogs consisting of shows with five or more seasons. The common thread: decades of broadcast and cable library ownership.

- Long-running series are a fixed resource. No one can manufacture a new 10-season franchise overnight. Studios that own these titles hold pricing power, and license fees will continue to reflect that scarcity.

- Depth drives retention. Subscribers mid-way through a long-running series are less likely to cancel. Platforms without legacy libraries face a slow path to building this kind of catalog advantage.

Long-running TV series are becoming streaming’s most contested currency.

While platforms race to produce buzzy originals, the data reveals a harder truth:

Established shows with multiple seasons are rare, concentrated among a handful of legacy owners, and increasingly expensive to license.

Using Reelgood catalog data, we examined TV libraries across eight major U.S. streaming platforms to understand just how scarce multi-season content really is.

The findings are striking: across every platform, the vast majority of TV catalogs consist of shows that lasted only one or two seasons.

The streamers with deep benches of long-running series aren’t necessarily the biggest. They’re the ones with decades of broadcast and cable history to draw from.

Most Catalogs Run Shallow

Across most platforms, 72% to 89% of TV shows available today ran for only one or two seasons. Paramount+ is the notable exception at 61%, reflecting its deeper bench of legacy series.

Prime Video, Apple TV, and Netflix skew most heavily toward short-run content.

On Netflix, 85% of TV titles are shows that ended after two seasons or fewer. Prime Video sits at 82%. Apple TV, still building its original library, tops the list at 89%.

This isn’t inherently a problem.

Streamers have invested heavily in limited series, anthology formats, and high-concept prestige shows designed to generate buzz and awards attention. But these titles, however acclaimed, don’t offer the same rewatch potential or passive viewing hours that a 7-season procedural provides.

The Platforms Punching Above Their Weight

Three services stand out for their relative depth in long-running series: Paramount+, Peacock, and HBO Max.

Each benefits from a legacy of broadcast and cable ownership that today’s streaming-first competitors can’t replicate.

Paramount+ leads the field with 21% of its catalog consisting of shows with five or more seasons. That’s 150 titles, including Star Trek: The Next Generation, Dexter, NCIS, and The Twilight Zone. The platform’s relatively modest overall catalog (700 shows) belies its density of established franchises.

Peacock follows at 16%, with 194 shows that have reached the five-season mark. NBCUniversal’s broadcast heritage shows up clearly here: The Office, Parks and Recreation, Law & Order, and 30 Rock all call Peacock home.

HBO Max rounds out the top three at 14% (251 titles with 5+ seasons), bolstered by HBO’s prestige catalog and the Discovery library merger. Titles like Game of Thrones, The Sopranos, Friends, and 90 Day Fiancé span very different audiences, but they share one thing: sustained multi-season runs that create deep viewer habits.

The Economics of Depth

Why does this matter?

Long-running series address two persistent challenges for streaming platforms: subscriber retention and passive viewing hours.

A subscriber who’s halfway through season four of a show they’re enjoying is unlikely to cancel. A household that reliably turns on The Office or Friends for background viewing represents hours of engagement that don’t require fresh content investment.

The supply of these shows is essentially fixed.

No one can manufacture a new 10-season sitcom overnight. The studios that own them know this, and license fees reflect it. This dynamic extends beyond TV: theatrical tentpoles face similar supply constraints in Pay-1 windows.

For platforms without legacy libraries, the path to multi-season depth runs through patience.

Netflix’s Stranger Things and Cobra Kai are now four and six seasons deep, respectively. But building a catalog of dozens of such titles takes years.

What This Means for Content Strategy

Platforms face a strategic choice:

Invest in originals that may or may not achieve multi-season longevity, or pay premium rates to license proven library titles from competitors.

The data suggests a third path. Streamers like Paramount+ and Peacock that already hold these assets have an under-appreciated competitive advantage.

They don’t need to outspend Netflix on originals if they can retain subscribers with deep, familiar libraries.

For content licensing and acquisition teams, the implications are clear: shows that have already proven they can sustain audience interest across five, seven, or ten seasons command a premium because they’re genuinely scarce.

There are only so many Law & Orders, Star Treks, and Twilight Zones to go around.

For catalog-level analysis like this across 300+ global streaming services, explore Reelgood’s data offerings.

Methodology Note:

This analysis is based on Reelgood catalog data as of February, 2026. Season counts reflect total seasons currently available on each platform, not the complete run of a series if seasons are split across services.